County Tax Assessor-Collector

The office of county tax assessor-collector originates in Article VIII of the state constitution. In each of Texas’ 254 counties with more than 10,000 people, county tax assessor-collectors are elected to serve four-year terms.12

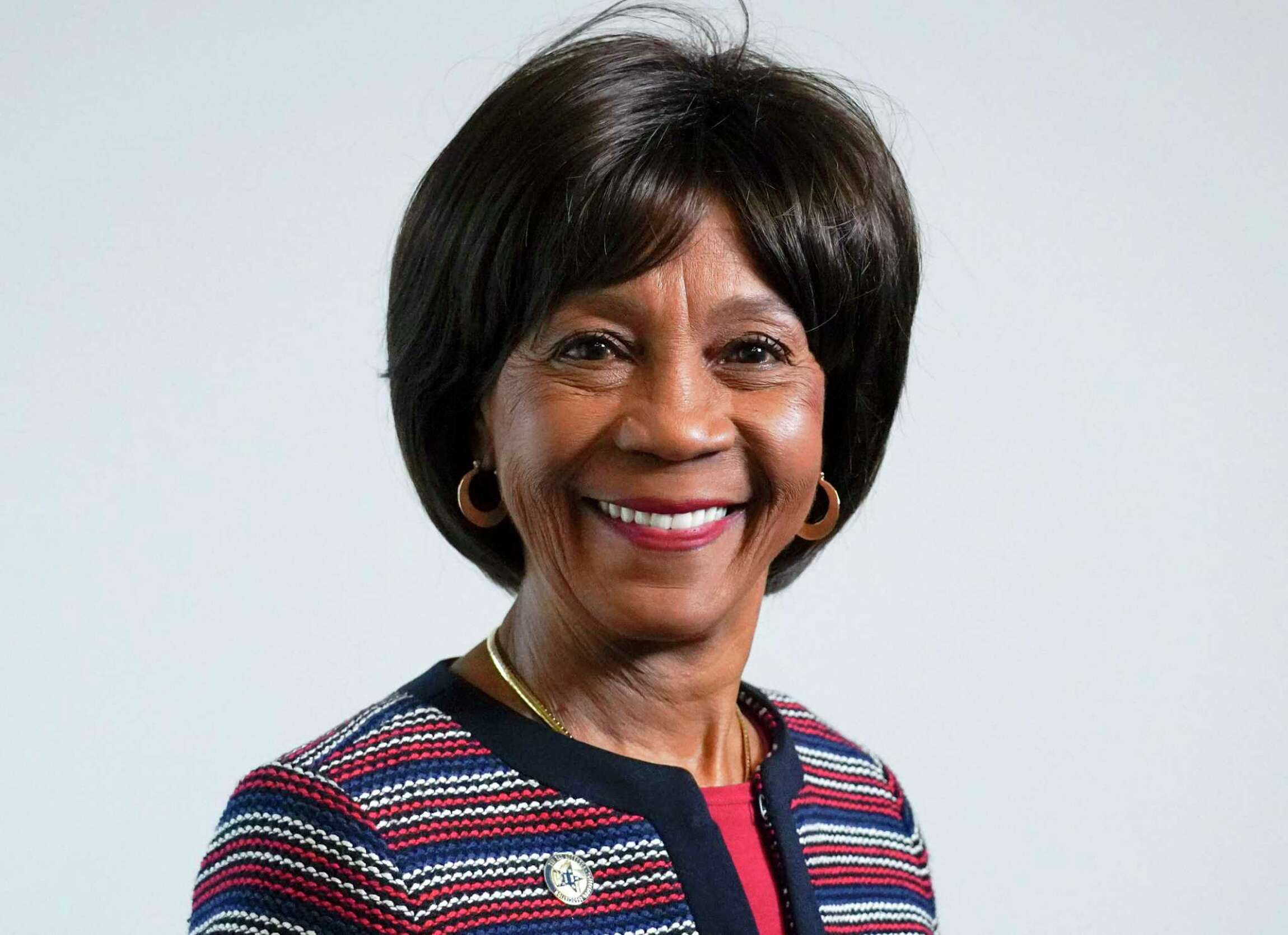

Ann Harris Bennett serves her second term as Harris County Tax Assessor-Collector. Bennett was re-elected in November 2020.3

Harris County Tax Assessor-Collector Ann Harris Bennett courtesy of Houston Chronicle

Harris County Tax Assessor-Collector Ann Harris Bennett courtesy of Houston Chronicle

Chief Tax-er

Unlike the county treasurer’s office, the county tax assessor-collector’s office is responsible for calculating property values and collecting property taxes, as well as vehicle registration and title transfers.

Historical Context

Barring an intervention by a judge or court, by this time next month Harris County will have abolished its Elections Adminsitration Department — as an outcome of this year’s state legislative session — and updating voter rolls would fall back to Bennett and the county tax assessor-collector’s office.4

November 2023 Elections

The Harris County District Clerk’s office isn’t scheduled to have an election until next year in 2024.

Nothing really for us to do as voters, aside from registering to vote!

Appendix: Sources

Texas Legislature Online - Texas Constitution Article VIII Taxation and Revenue Section 14 Assessor and Collector of Taxes ↩

Texas Legislature Online - Tax Code Title I Property Tax Code Subtitle B Property Tax Administration Chapter VI Local Administration Subchapter B Assessors and Collectors ↩

Houston Chronicle — We recommend Ann Harris Bennett for Tax Assessor-Collector and Voter Registrar in the Democratic Primary [Editorial] ↩

Texas Tribune — Texas Republican leaders want to improve elections in the state’s largest county. Their solution could backfire. ↩